Seven years ago, the so-called «Moscow's turn to the East» occurred - a «gas contract of the century» was signed in Shanghai in the presence of Vladimir Putin and Xi Jinping, according to which gas was to be supplied to China via the Power of Siberia gas pipeline. Russia and China agreed on numerous joint projects, most of which have remained on paper.

Having broken up with the West after the annexation of Crimea, Russia has not only failed in global economic partnership with China but has been selling natural resources at a loss and on Chinese terms, spending money from the National Wealth Fund and enriching Chinese companies and Vladimir Putin's friends.

Seven years is sufficient time to draw conclusions about how successful the new Russian-Chinese partnership turned out to be. In short, by and large it turned into zilch: most of the announced projects have not been implemented, and those that are still kicking have brought huge disappointment over the low prices being paid for supplied commodities and zero revenues for the budget due to colossal concessions to suppliers, tax-related and otherwise. Russia exports raw materials to China at extremely low prices, and the state gets nothing in return, but Russia's natural environment has suffered enormous damage - entire regions have become or may become zones of ecological disaster as a result of supplying natural resources to China. Paradoxically, on top of that we owe money to China.

But first things first. The large-scale cooperation plans announced in May 2014 remained castles in the sand. The following projects were loudly announced, but never actually materialized:

- Vladivostok-LNG, a liquefied natural gas producing plant,

- western pipeline to supply gas to China (it is called Altai, or, alternatively, the Power of Siberia 2, or a gas pipeline through Mongolia, which is yet to show any signs of life),

- Eastern Petrochemical Complex,

- participation of Chinese investors in the development of Rosneft fields,

- construction of a Rosneft refinery in Tianjin, China,

- participation of China in the construction of the Moscow-Kazan high-speed railway,

- wide-body long-range CR929 aircraft (which does not yet exist), and much more.

In fact, the only things that have materialized are the construction of the Power of Siberia gas pipeline, China's involvement in Novatek's gas liquefaction projects (Yamal LNG and Arctic LNG 2), and the partnership of Chinese companies with Sibur and the construction of the Amur gas chemical complex. Compared to the original plans for a «new global partnership,» all this looks very modest, and became possible only because of those projects being granted unprecedented tax exemptions – all taxes were cut to zero.

The unprofitable Power of Siberia

The Power of Siberia gas pipeline was put into operation a year and a half ago, and the volume of gas supplied through it is still infinitely smaller than the declared peak capacity of 38 billion cubic meters; only 4 billion cubic meters of gas was pumped in 2020. For comparison, 147 billion cubic meters was supplied to Europe. Clearly this cannot be called “a retreat from Europe to the East», especially since the resource base for the gas pipeline is located in the extremely remote East Siberian fields, Chayanda and Kovykta, with no chance of the gas reaching the European market.

Talks about building a bridge between China and West Siberian gas fields are still just talks. Another question is whether Gazprom has enough gas to fulfill its obligations even at 38 billion cubic meters per year: last year, alarmist statements by former Gazprom employees appeared in the press to the effect that the Chayanda and Kovykta reserves may have been overestimated and certain mistakes had been made in their development, so there may not be enough gas.

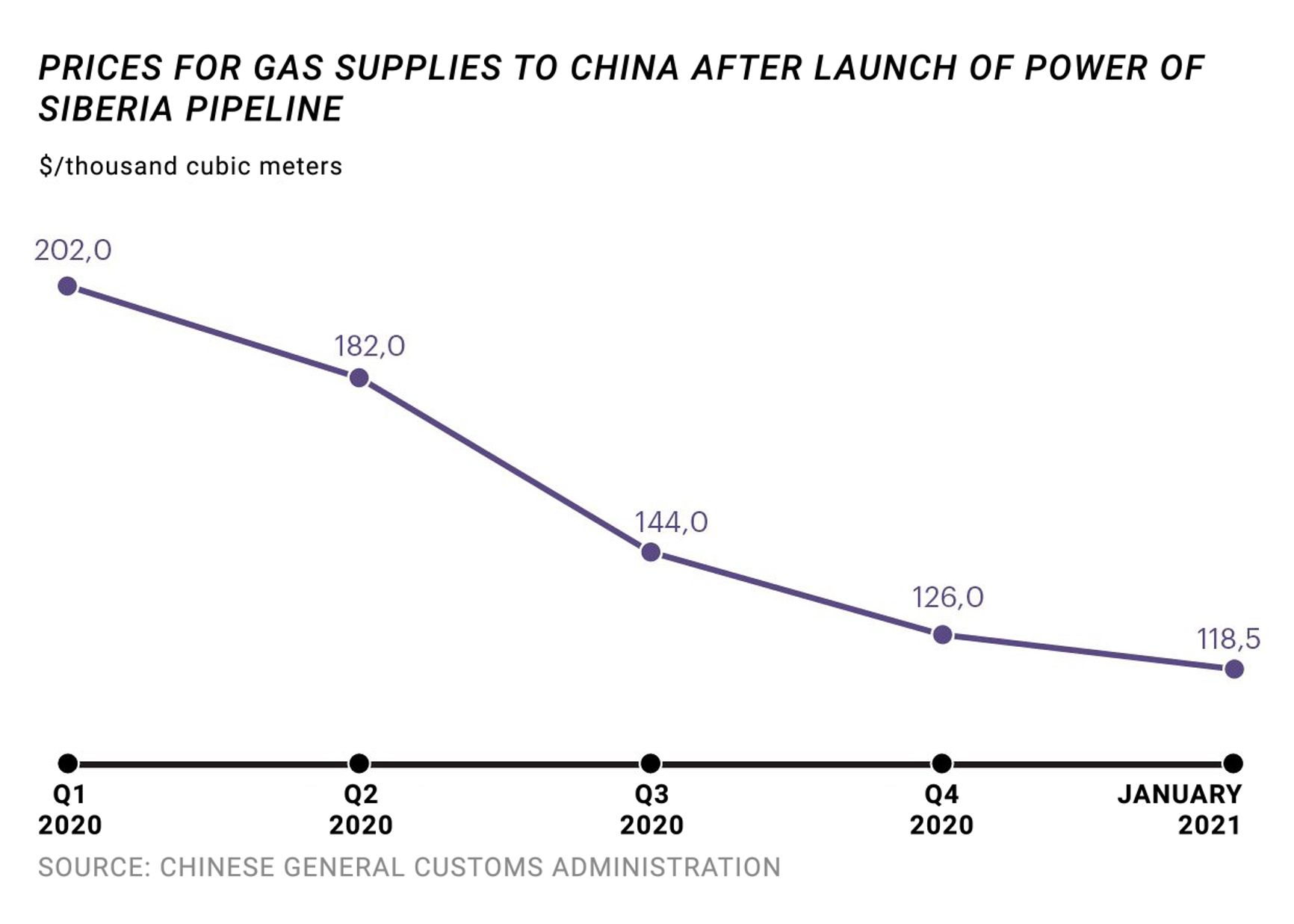

But the most interesting point is the price of the supplied gas. When the “contract of the century” was signed in May 2014, it was frequently stated that the estimated price of gas to be supplied under the contract would be $350-380 per thousand cubic meters. Gazprom refused to name the price, but claimed it was «excellent», and the head of Gazprom Export Alexander Medvedev, when asked about the price, mockingly replied: «Oh, we don't need every housewife to be concerned about the prices.»

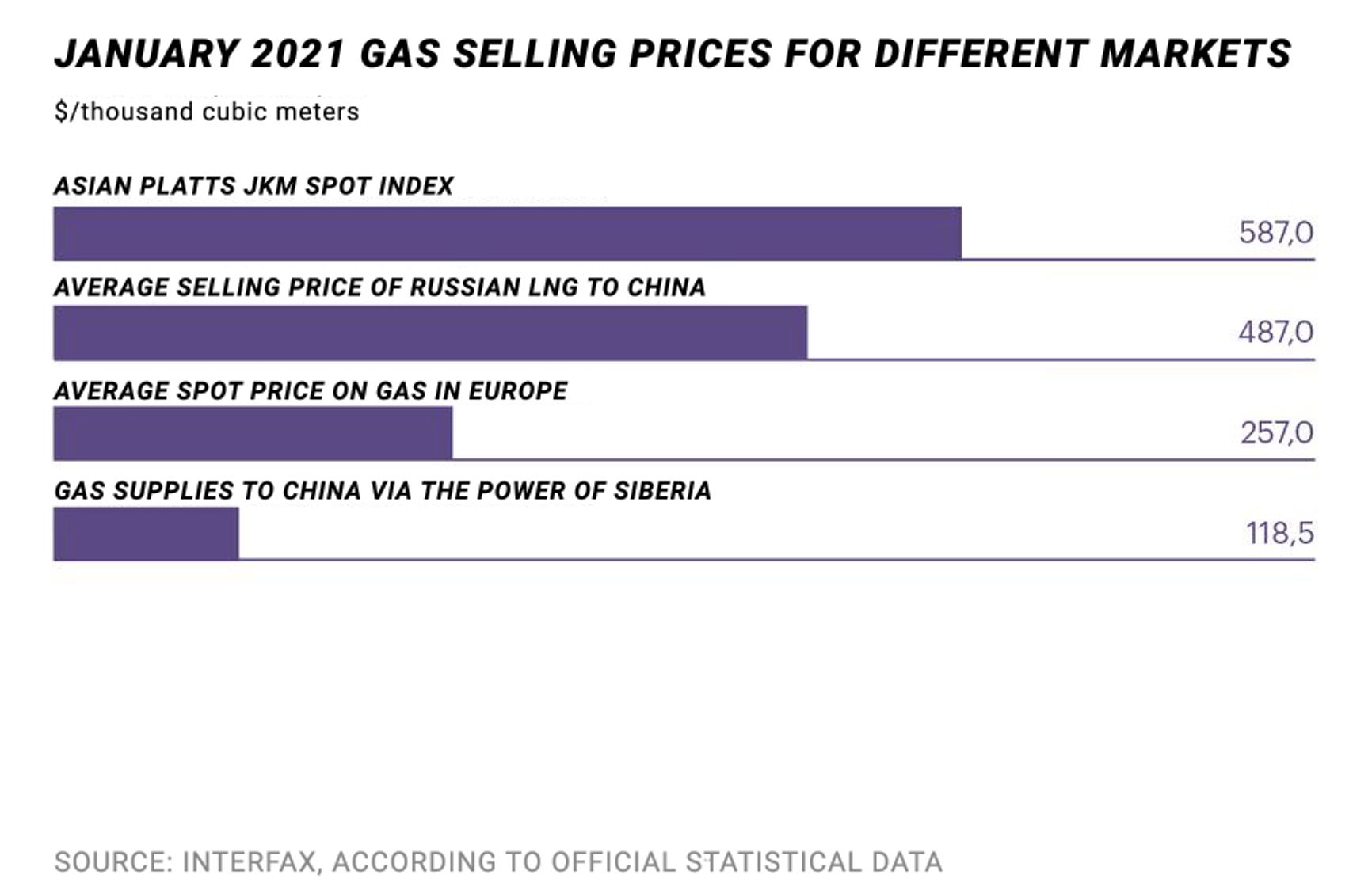

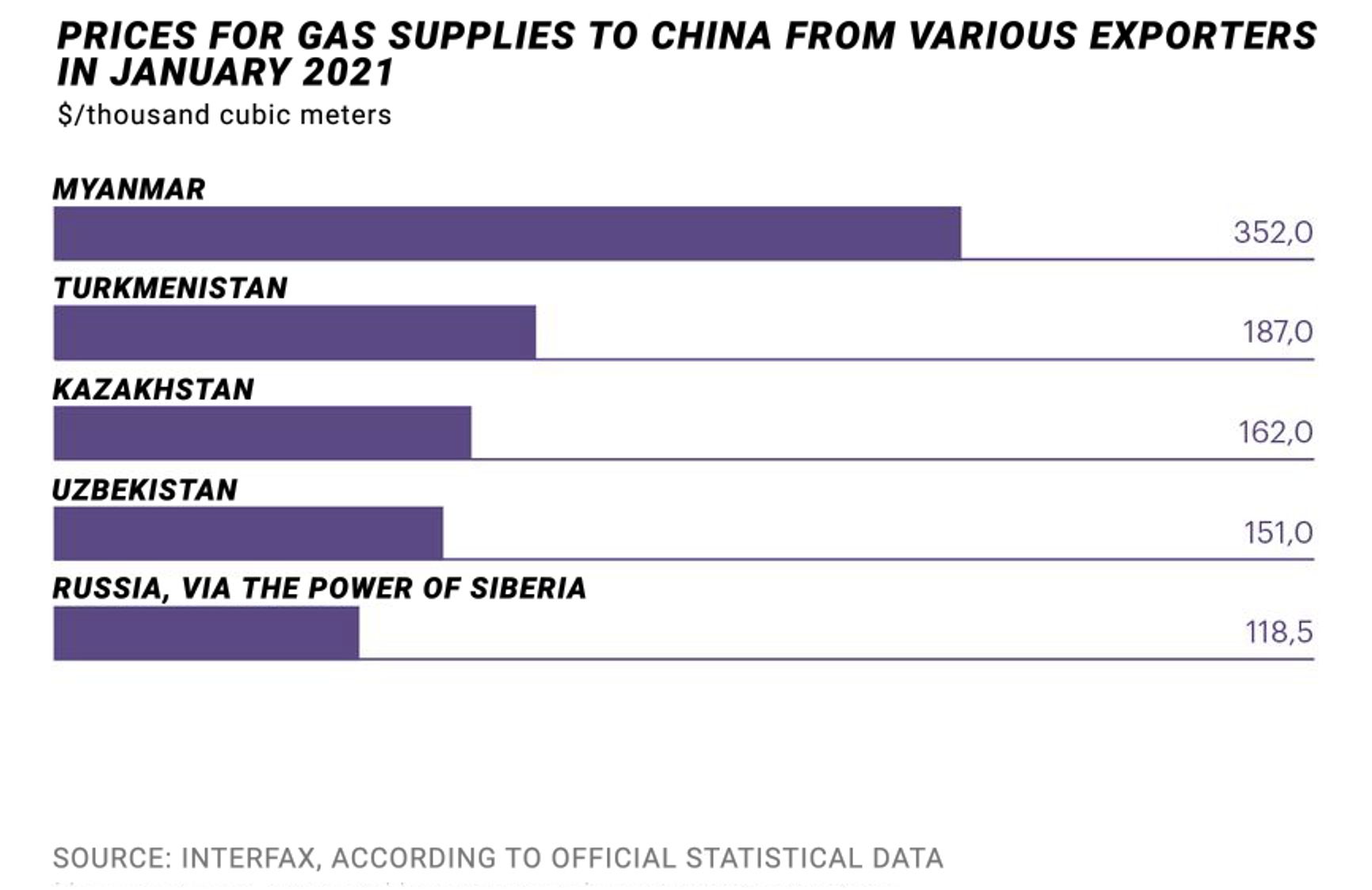

Today, thanks to the data published by the Chinese General Customs Administration, we know the price - and it is not $350, nor is it $380, it is only… $118.5 per thousand cubic meters! This is three times lower than the gas price that was publicly announced three years ago, and, as is apparent from the above link to Interfax, it is significantly (several times) lower than all current gas prices – either for LNG supplies, or on the European spot market, or for pipeline gas supplies to China from Myanmar and Central Asia (Myanmar, for example, sells gas to China at a price three times higher than that of the Russian gas sold through the Power of Siberia).

Russia sells gas to China three times cheaper than publicly promised

This state of affairs cannot be called anything other than an incredible shame for Gazprom's so-called businessmen. In their language, any housewife would have managed to do better. Yes, the gas supply prices will rise to a certain extent along with oil prices, but not much higher than the current $60-70 per barrel - and the gas price range of $100-200 for China is completely unsatisfactory. This catastrophe is aggravated by several circumstances. Firstly, even the price of $350-380 never guaranteed profit to Gazprom.

To arrange supplies, it was necessary to build 2,200 km of gas pipeline through a completely deserted remote area (in the taiga), where materials and equipment had to be delivered by air. The construction cost more than a trillion rubles. The prime cost of gas production at the Chayanda field back in 2010 was estimated at over $80 per thousand cubic meters - now, obviously, the cost is much higher (even if due to the depreciation of the ruble only). The current prices generate only giant losses. Note that the price of gas for China was not even close to what was announced ($350-380) - even a year ago it barely exceeded $200:

China, gas prices dynamics

World prices for gas

Gas prices in Asia

Losses from gas supplies to China are no joke: they have diminished Gazprom's tax and dividend base and, accordingly, budget revenues. As long as the volumes are small, it is not very noticeable. But what will happen when they start to approach the expected 38 billion cubic meters per year target?

Gazprom was granted unprecedented tax concessions for the «Power of Siberia» – mineral extraction tax and property tax were cut to zero. That is, the budget does not get anything from the project at all, and considering the losses, the project has also reduced the amount of tax and dividend income that the budget would have otherwise earned from Gazprom. Instead, it was the construction contractors who benefited from the project, primarily Arkady Rotenberg's and Gennady Timchenko's business entities which won the Power of Siberia construction contracts without competition (one, two).

The Power of Siberia pipeline was a blow to the Russian budget, but it enriched Rotenberg and Timchenko.

Liquefied gas: China's onerous terms

Alas, it is not all about Gazprom. Another major gas exporter to China, Novatek, although it sells gas at a higher price (the price has also not been disclosed, but LNG costs significantly more), does not pay any sales taxes. For the Yamal LNG project, the company was granted blanket tax incentives – zero MET, export duties and property tax, profit tax concessions and VAT exemptions for equipment imports.

Moreover, these exemptions were provided not at the request of Novatek but as conditions precedent set by the Chinese side. Chinese companies got a 30% stake in the Yamal LNG project (and a corresponding share of profits from tax exemptions) and in exchange demanded that the Russian government sign and ratify an intergovernmental agreement on the Yamal LNG project which guaranteed zero taxes and VAT exemption for imported Chinese equipment. At the same time, China's obligations were to «arrange for Chinese companies to join the project» (and make a profit from tax-free export of LNG to China).

The terms of this agreement cannot be called anything other than onerous - China ended up being its main beneficiary, while Russia exempted the project from almost all taxes. I remember numerous heated discussions when homegrown opponents of the West criticized the «production sharing agreements» of the 1990s. By means of those agreements the state had been receiving several billion dollars a year in revenues, whereas it will get nothing from Novatek's LNG exports – as per China's request and according to the terms of the intergovernmental agreement. And we have heard no outcry of rage against it from jingoistic patriots.

Concessions for China secured by Sibur

The next example is Sibur. This company is also one of the largest recipients of tax exemptions from the state – it would be tiresome to list all of them here, just Google «Sibur tax exemptions». Without these exemptions, the company's petrochemical business would have been impossible on the scale it is conducted today - in my latest video about the unprofitable economic ties with China I cited a fragment of the speech by Sibur President Dmitry Konov at a meeting with Putin in Tobolsk on December 1, where Konov spoke openly about the low profitability of petrochemical production and pointed out that practically all of their product lines were “covered by tax benefits” granted by the Ministry of Finance.

What does China have to do with it? China is not only the main consumer of Sibur's petrochemical products, but also the largest shareholder and beneficiary of the company's projects: Chinese investors already control 20% of Sibur, and Chinese Sinopec bought a 40% stake in the company's largest project, the Amur Petrochemical Complex (ANHK), which targets the Chinese market exclusively. ANHK is an important supplement to the Power of Siberia - it will use valuable components of the transported gas to produce petrochemical products, polyethylene and polypropylene.

Well, Sibur categorically refused to launch that project without large-scale tax exemptions - which were eventually granted despite the resistance of the Ministry of Finance, which openly said it did not «intend to finance the construction of Sibur at the government's expense.» But in the end, it had to give in – given that Sibur had Putin's old friends and relatives Gennady Timchenko and Kirill Shamalov as its shareholders (Timchenko is also the second largest shareholder of Novatek, another important beneficiary of tax incentives for China).

But that is not all! For their tax exempted China projects Novatek and Sibur received huge amounts of money from the National Welfare Fund (NWF) - the fund that Putin flatly refused to unseal last year to provide aid to the population and economy during the pandemic. But Novatek and Sibur received 150 billion rubles and $1.75 billion, respectively, from the NWF, and on highly preferential terms – low-interest loans for 15 years; ordinary Russian businesses cannot even dream of gaining access to such lucrative deals.

Novatek and Sibur received huge money from the NWF, which Putin refused to unseal to help the population

It was China that benefited from all of this. And not only in terms of obtaining the necessary raw materials; for example, Novatek is the largest importer of Chinese equipment for its LNG projects, and it has been actively hiring Chinese oil service companies and shift workers to work in Russian fields. It has ordered equipment in China for the Amur GCC and Sibur. All of this was financed by generous tax breaks and money from the NWF - which, as you may recall, is not supposed to be spent on us, Russians.

Not tired yet? Then a few words about another important area - oil export.

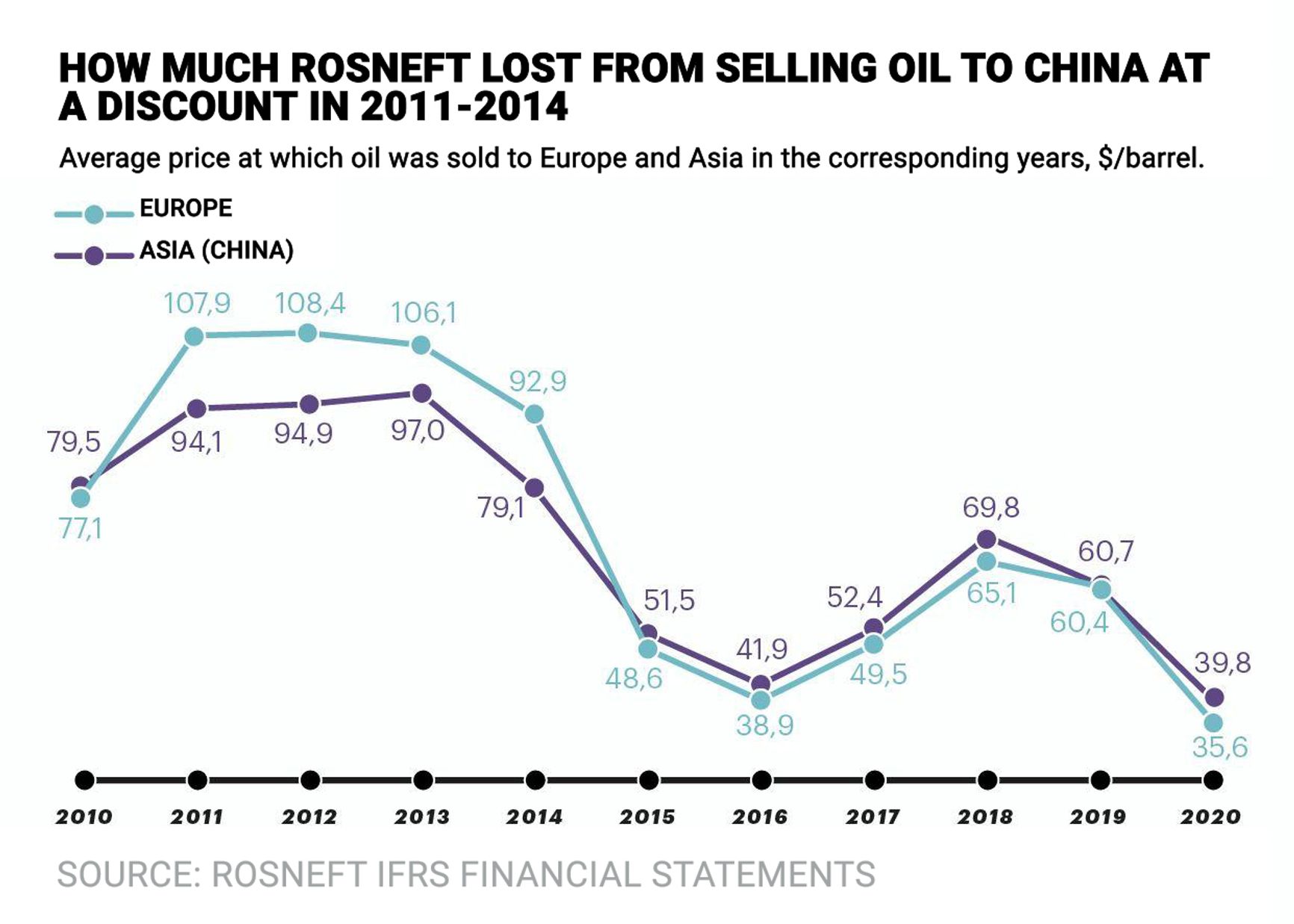

Oil: China dictates the terms and provides expensive loans

Thanks to the construction of the Eastern Siberia-Pacific Ocean oil pipeline, Russia was able to more successfully diversify its exports to China; today China consumes nearly 30% of Russia's crude oil exports (more than half of them still go to Europe), and only 2% of oil product exports (two-thirds of oil product exports go to Europe). But how profitable are those exports to China? From the outset, Rosneft provided China with significant price incentives, as a result of which, if you look at the company's financial statements prepared to international standards, direct losses alone caused by lower prices for oil supplies to China amounted to about $9bn.

Average price at which oil was sold to Europe and Asia in the corresponding years, $/barrel

But even then, the situation did not improve much: the prices of oil exports to China and Europe actually leveled off, although, in theory, oil sold through the Eastern Siberia-Pacific Ocean pipeline should be priced much higher – ESPO-graded oil sold to the East does not mix with the Ural-Volga sulphureous grades and has better characteristics than the Urals sulphureous oil supplied to Europe. From all appearances, it should be much more expensive. In addition, export to China is associated with high transportation costs - transporting a barrel from Rosneft's Vankor field to the Chinese border costs nearly $1.5 per barrel more than to the port of Primorsk in the Baltic. The question is: are there enough benefits from supplying oil to China? Not to mention the fact that Rosneft has become a recipient of colossal tax incentives for its China-oriented projects – every eastern project gets to enjoy zero taxes.

What is most surprising is that as a result of all these projects, with China getting generous discounts, the Russian budget did not get any money; on the contrary, it's Russia which owes money to China! If you look at the financial statements of our oil and gas companies, it is immediately clear who their largest creditors are – it is China Development Bank for Rosneft, and China Construction Bank for Gazprom. Novatek took the largest loans from Chinese banks and the Silk Road Fund. Rosneft, according to the latest reports, is supposed to supply oil and oil products for 1.7 trillion rubles (already prepaid and spent) – it is also a debt, which is owed almost entirely to China.

The projects grant China generous discounts and do not bring money to the Russian budget; on the contrary, it is Russia which owes money to China!

It is simply amazing: deliveries to China are not only accompanied by lost profits, incredible tax breaks and funding from the NWF, but we also ... end up in debt to China! A truly unique relationship between a country exporting natural resources and a consumer country dependent on imports. In theory, the importer should beg us for favorable supply terms, but instead it dictates those terms to us, forces us to buy its equipment and take its expensive loans, and we end up in debt.

What else is worth mentioning? Russia has become a key supplier of two more types of natural resources to China - coal and timber.

Coal and timber exports: meager income, smuggling and environmental disaster

Large-scale open-pit coal mining and massive coal transshipments in the Far East prior to export to China have led to a real environmental disaster in the Kuzbass and on the Pacific coast of Russia. Meanwhile, the authorities, together with big businesses, are likely to exacerbate the catastrophe by making plans to dramatically increase coal exports to China by doubling them in 10 years.

Perhaps it will bring colossal funds to the country's budget? Let us check by consulting the Federal Treasury website and downloading data on the country's 2020 consolidated budget. What do we see? All budget revenues from coal mining tax in 2020 amounted to only 12.4 billion rubles, or 0.03% of budget revenues! Let me remind you that the Zaryadye Park in Moscow cost (Moscow Mayor) Sobyanin 14 billion rubles - more than the state has received from the entire coal industry, which is a source of incredible environmental disasters for several the country's eastern regions.

Zaryadye park in Moscow costs more than the budget received from the entire coal industry in a year

At the same time, we have also subsidized all non-profit coal exports! Coal miners traditionally received large discounts from Russian Railways for the transportation of coal exports, and now there are plans for 175 billion rubles out of the National Welfare Fund being targeted at the construction of the eastern branch of the Baikal-Amur Mainline (BAM) to expand coal exports to China.

A little more money (by a small margin) has been earned for the budget from the exploitation of Russian forests, where China is also a key beneficiary. No matter how many times our authorities repeat they would ban exports of unprocessed timber («round timber»), the country still exports nearly 15 million cubic meters of round timber a year, 70% of which goes to China. But those are only official figures - a significant part of the roundwood is exported in the form of rough wood under the guise of «lumber», and besides, you have probably heard about the large-scale smuggling of roundwood into China. The scale of it cannot be accurately estimated, but it is clearly very large - a couple of years ago the news agency Data.ru in Primorsky krai tried to do the calculations based on Chinese statistics, and, despite some methodological errors, the results suggested the scale was very large (see «Russian forests go to China in uncountable quantities and for nothing»).

The fact that timber smuggling to China is protected at the highest level is evident from the recent news of the arrest of Lev Chikichev, former transport prosecutor of Irkutsk, who was directly accused of covering up such smuggling for bribes. It should be noted that the Irkutsk region is the largest logging and timber exporting region in Russia, and Chikichev was appointed to his post in 2010 by none other than ex-prosecutor general Yuri Chaika. From these two facts, it follows that timber smuggling to China was organized at the highest level and, most likely, is a systemic and large-scale operation, given the important role of Irkutsk in export flows.

How much does the state earn from deforestation in the interests of China? Let us consult the consolidated budget of Russia again. In 2020, state revenues from payments for forest use amounted to 58.3 billion rubles, or 0.15% of the consolidated budget revenues. Those are all revenues from the timber industry, and as most timber goes to the domestic market, revenues from logging for China exports make up just a few percent of the total amount, no more than 5-10 billion rubles.

Some earnings come in the form of export duties - but revenues from all non-oil or gas related export duties (all commodity items not related to hydrocarbons - there is no separate line for timber export duties in the Treasury reports) amounted to 16.6 billion rubles, or 0.04% of all consolidated budget revenues, in 2020. It is a little more than was spent on the Zaryadye Park, but still the amounts are microscopic.

Thus, in practice Russia has not been receiving significant income from the exploitation of its important natural resources - coal and timber - which are largely exported to China. But the exploitation leads to catastrophic consequences for the natural environment. By the way, Sibur with its oil and gas chemical projects should also be included, because the petrochemical sector is one of the largest sources of air pollution. All this huge environmental damage is being done for the sake of China.

Conclusions?

If you have ever heard the phrase «raw-materials appendage», it is an ideal description of the existing relations between Russia and China. We supply China with resources at huge discounts, and the budget gets nothing in return - taxes for almost all the projects have been cut to zero. We also finance the projects out of the National Welfare Fund and provide subsidies by means of lower railway tariffs. We also create jobs in China by purchasing their equipment and borrowing money from Chinese banks. Why are we doing it like this? What is the economic sense of such cooperation? Pleasing China? But what for?

The answer, in principle, lies on the surface - Putin has sunk so deep into his geopolitical gameplay that he stopped caring about the gigantic costs and environmental damage caused by the unbalanced relationship with China based mostly on sales of raw materials. For the sake of demonstrating a «global partnership against the West,» he is prepared to throw around even more money. Putin's friends, corrupt officials, who have deftly earned billions on the unprofitable geopolitical «friendship» (they all have mastered the art of making money on unprofitable projects) are on standby. From the latest news: the Russian Central Bank is losing NWF money on investments in the Chinese RMB, which also has a clear geopolitical implication: since 2016, the Central Bank has increased its share of investment in the RMB from zero to 12-15%, while the RMB has depreciated against the dollar by nearly 10%. Clearly, this has been done to please Beijing, the new «geopolitical ally,» without regard to Russia's interests.

When someone tells you about how Putin “protects the sovereignty of Russia” from the “insidious West” - show him this article. There has been no sovereignty for a long time, Russia and its resources are being used at the whim of the new Chinese masters. This information should be known as widely as possible by all our citizens - here is a link to the video version.

This article is also available in Russian.