Approximately 10% of American voters in swing states — Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin — are still unsure about their choice for November’s presidential election, and according to polls, the economy will be the key deciding factor for this group. Although all economic indicators — GDP, unemployment, inflation, stock market indices — suggest a robust improvement since Joe Biden took office in January 2021, public perception is quite the opposite: the majority of Americans believe the country is in a recession, and that unemployment is reaching record-high levels. This peculiar public sentiment has been termed a “vibecession” — a feeling of economic malaise that does not in fact conform to reality. This perception is largely influenced by the fact that economic growth is primarily occurring in Republican states, where the population is influenced by Trump's rhetoric about the economy's weakness under Biden. It remains to be seen whether this sentiment will shift in time for the election.

Content

Biden's economic achievement

The recession myth

Causes of misguided perception

Waging on the interest rate

The cohort of undecided American voters notably diverges from a larger sample, as revealed in a survey conducted by The Wall Street Journal. Undecided respondents do not strongly identify with either Republicans or Democrats, nor are they heavily focused on contentious partisan issues like immigration, abortion, or gun control. Their primary concern typically revolves around economic results, which serve as their main criteria for candidate selection. Normally, such voters tend to support the incumbent when the economy is thriving and the challenger when it is not. But in 2024, things might not be so simple.

Biden's economic achievement

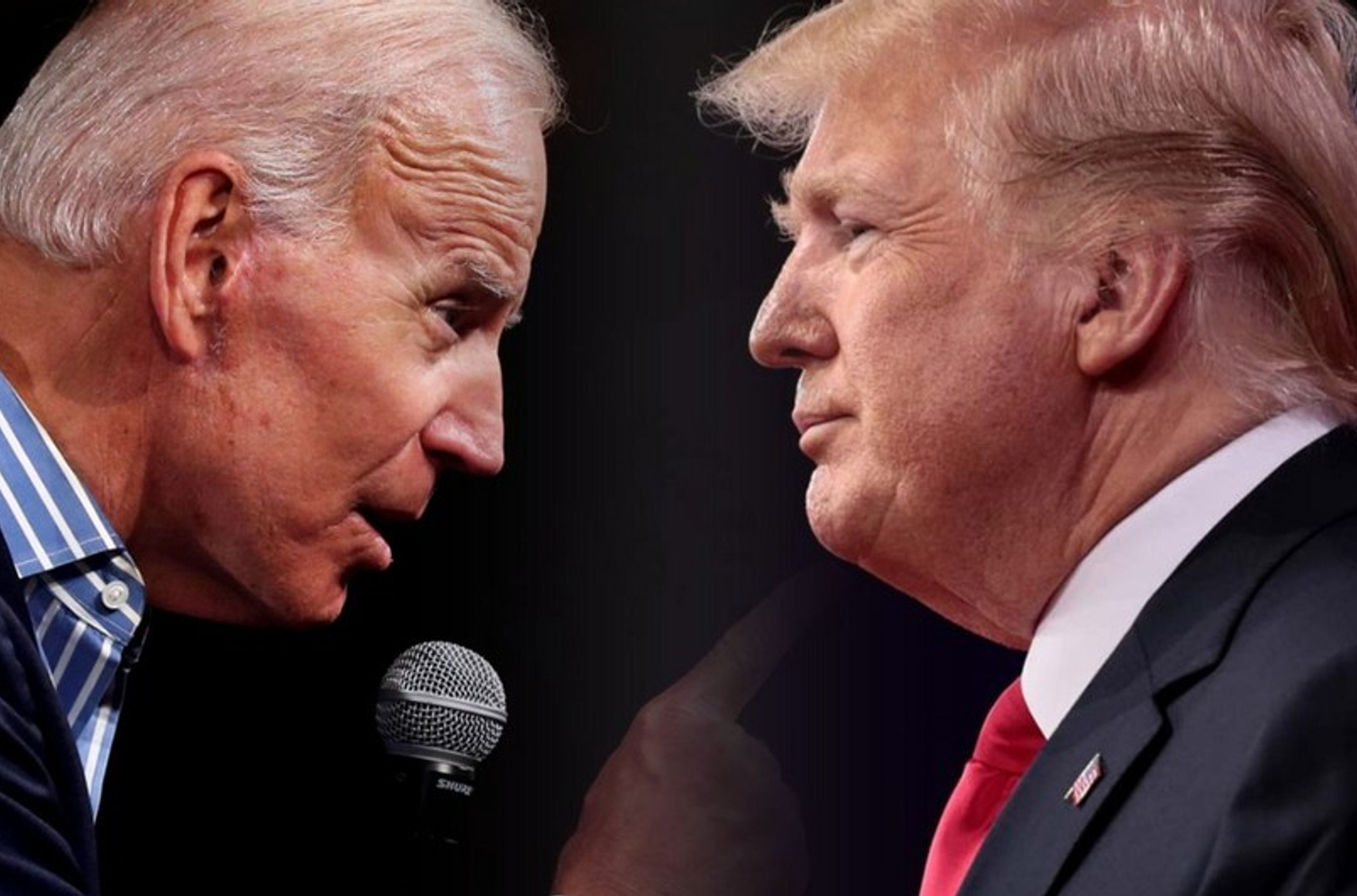

Joe Biden counts economic successes as foremost among his achievements as president, and not without cause. Under Biden, the U.S. economy is on an upward trajectory, surpassing growth rates in the EU, UK, and Japan. Nominal GDP is increasing by hundreds of billions of dollars each quarter, and per capita GDP has rebounded to a trend of stable post-pandemic growth. Inflation has decreased from nearly double digits to 3.4%, while unemployment remains remarkably low at 3.9%.

The economic stimulus efforts launched during COVID-19, initiated by Donald Trump and continued under Biden, instilled businesses with enough confidence to rehire nearly all those who lost their jobs early in the pandemic. However, the subsequent period of high inflation significantly complicated life for ordinary Americans. Price hikes occurred partly as the result of supply chain disruptions from lockdowns, and logistical factors were subsequently exacerbated by the war in Ukraine. Economists generally agree that without such extensive stimulus measures, the inflation surge would not have been as pronounced — but then again, without the liquidity pumped into the depressed COVID economy first by Trump, then by Biden, other factors like GDP growth and unemployment would likely be less robust today.

The interest rate is a key parameter of the financial system, determining the cost of money. Commercial banks borrow from the Federal Reserve based on this rate.

Real wages indicate how many goods and services can be purchased with a given salary. It is calculated by taking the index of nominal wages, expressed in monetary terms, divided by inflation.

From «vibe» and «recession»: A widely prevalent pessimistic view of the economy despite optimistic statistical indicators.

The recession myth

The U.S. population seems to still be recovering from the trauma inflicted by the pandemic. People's perceptions are lagging behind reality:

- 55% believe there is a recession in the U.S., despite the economy actually growing;

- 49% think the S&P 500 stock market index has declined over the past year, when in fact it increased by about 24% in 2023 and by more than 12% since the beginning of 2024;

- 49% believe unemployment has reached a 50-year high, whereas it is actually near a 50-year low.

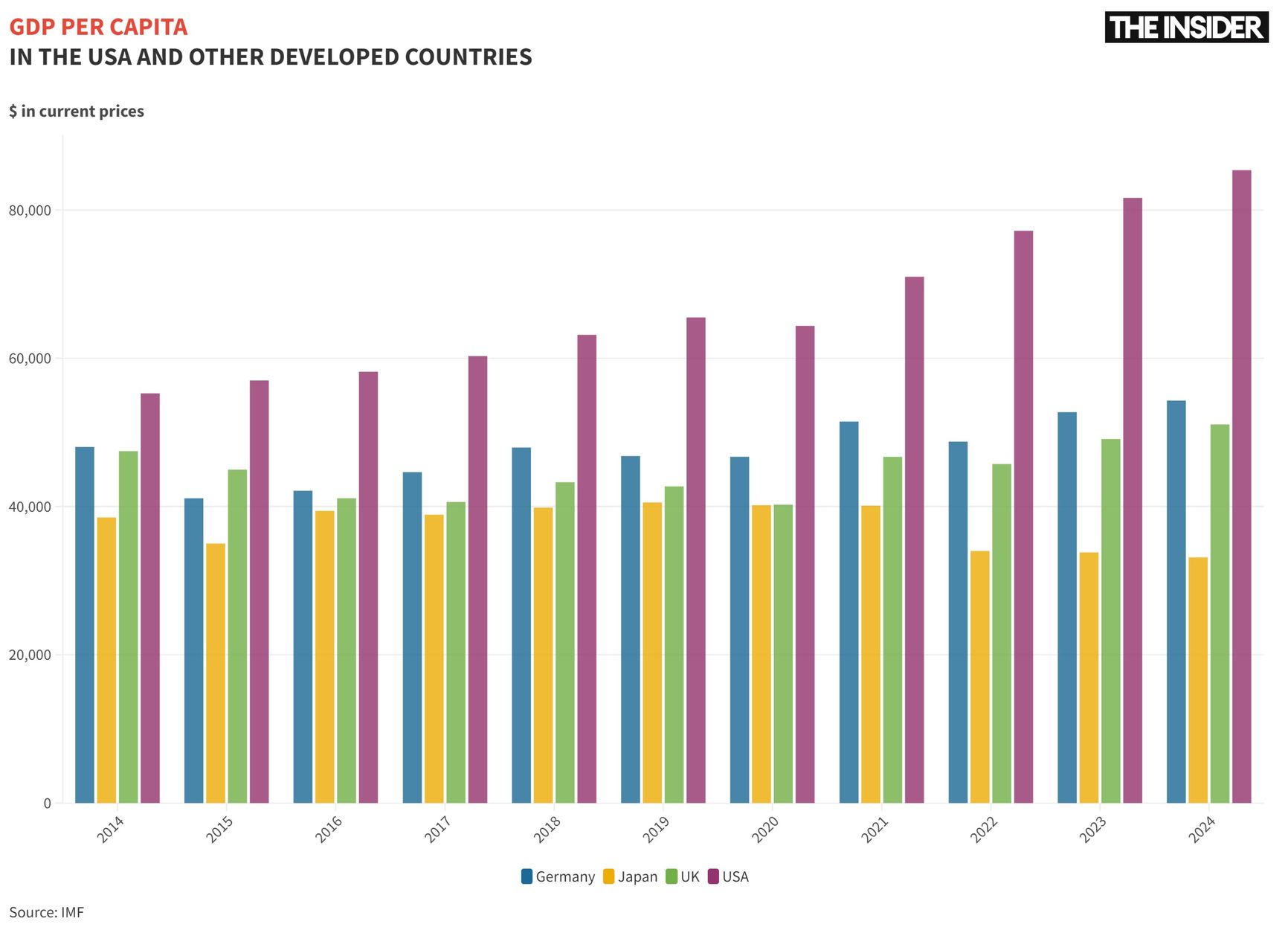

Looking at the statistics, it is evident that until 2020, economic indicators such as GDP and unemployment showed a strong correlation with consumer sentiment. However, after the pandemic, this relationship remarkably flipped in the opposite direction.

The interest rate is a key parameter of the financial system, determining the cost of money. Commercial banks borrow from the Federal Reserve based on this rate.

Real wages indicate how many goods and services can be purchased with a given salary. It is calculated by taking the index of nominal wages, expressed in monetary terms, divided by inflation.

From «vibe» and «recession»: A widely prevalent pessimistic view of the economy despite optimistic statistical indicators.

The correlation between the economy and public sentiment was very strong (0.9) before the 2020 pandemic, and became strongly negative (-0.7) afterward

Multiple surveys indicate that Americans have a negative outlook on the current economic situation, especially in their assessment of President Biden's record as compared to Trump's (1, 2, 3). A majority (51%) of Americans perceive the state of the economy as poor, with nearly a quarter (23%) finding it satisfactory and only 26% considering it good. Another survey shows that 65% of Americans believe the economy was in good shape under Trump. Additionally, 58% of respondents believe the current situation is deteriorating due to mismanagement by the Biden administration. Only 19% of African Americans, 13% of Hispanic Americans, and 12% of young voters believe economic conditions are improving — the vast majority in these groups think the opposite. Among Democrats, only 21% report improved economic conditions over the past year, while 22% say the opposite.

Causes of misguided perception

The negative outlook of the public, which contrasts with official statistics, has been labeled a “vibecession.” In essence, 2023 was not a year of recession, but rather one marked by pervasive negative vibes. Economist Paul Krugman encapsulated this sentiment: “I'm fine, people I know are fine, but somewhere out there, someone is just doing terribly.”

Throughout 2023, social media featured discussions about the downfall of the U.S. economy — this despite its fairly rapid recovery from the impact of pandemic-era lockdowns. Americans tend to over rely on social media for news, and content creators often boost viewership by exploiting readers' preference for negative content. A recent study by American economists highlighted a significant decline in public perceptions of the economy in U.S. media over recent decades, despite ongoing economic growth.

The interest rate is a key parameter of the financial system, determining the cost of money. Commercial banks borrow from the Federal Reserve based on this rate.

Real wages indicate how many goods and services can be purchased with a given salary. It is calculated by taking the index of nominal wages, expressed in monetary terms, divided by inflation.

From «vibe» and «recession»: A widely prevalent pessimistic view of the economy despite optimistic statistical indicators.

Over the years, the tone of economic reporting in U.S. media has consistently deteriorated, despite economic growth

In the competitive landscape of U.S. media, there is also strong polarization along political lines. When Trump was elected president in 2016, Republicans became notably optimistic about the economy, a sentiment echoed and amplified by their supportive media outlets. Conversely, Democratic channels at the time often portrayed the economic outlook as unfavorable. These roles reversed in 2020 following Biden's election.

However, even Democrats currently maintain a relatively pessimistic outlook on the economy. This shift can be attributed to state-specific circumstances. Economies in Republican-leaning “red” states are experiencing faster growth when compared with Democratic-leaning “blue” states. One contributing factor is the difference in regulatory frameworks. Strict zoning regulations in “blue” states make it challenging to develop new homes and businesses, contributing to housing affordability issues. As a result, populations are migrating to “red” states, which are consequently gaining more representation in the House of Representatives based on population size.

Furthermore, due to inflation, real wages are increasing at a slower pace than GDP, and they have yet to recover to pre-pandemic levels. Americans are focused not only on statistics, but also on food prices, which are rising faster than the general consumer basket. As a result, their subjective economic outlook is often less positive than the numbers suggest it should be.

Income inequality is another source of irritation for the population. That metric again increased after the stimulus measures expired, meaning that a limited percentage of Americans have genuinely profited from Biden's rapidly expanding economy.

Waging on the interest rate

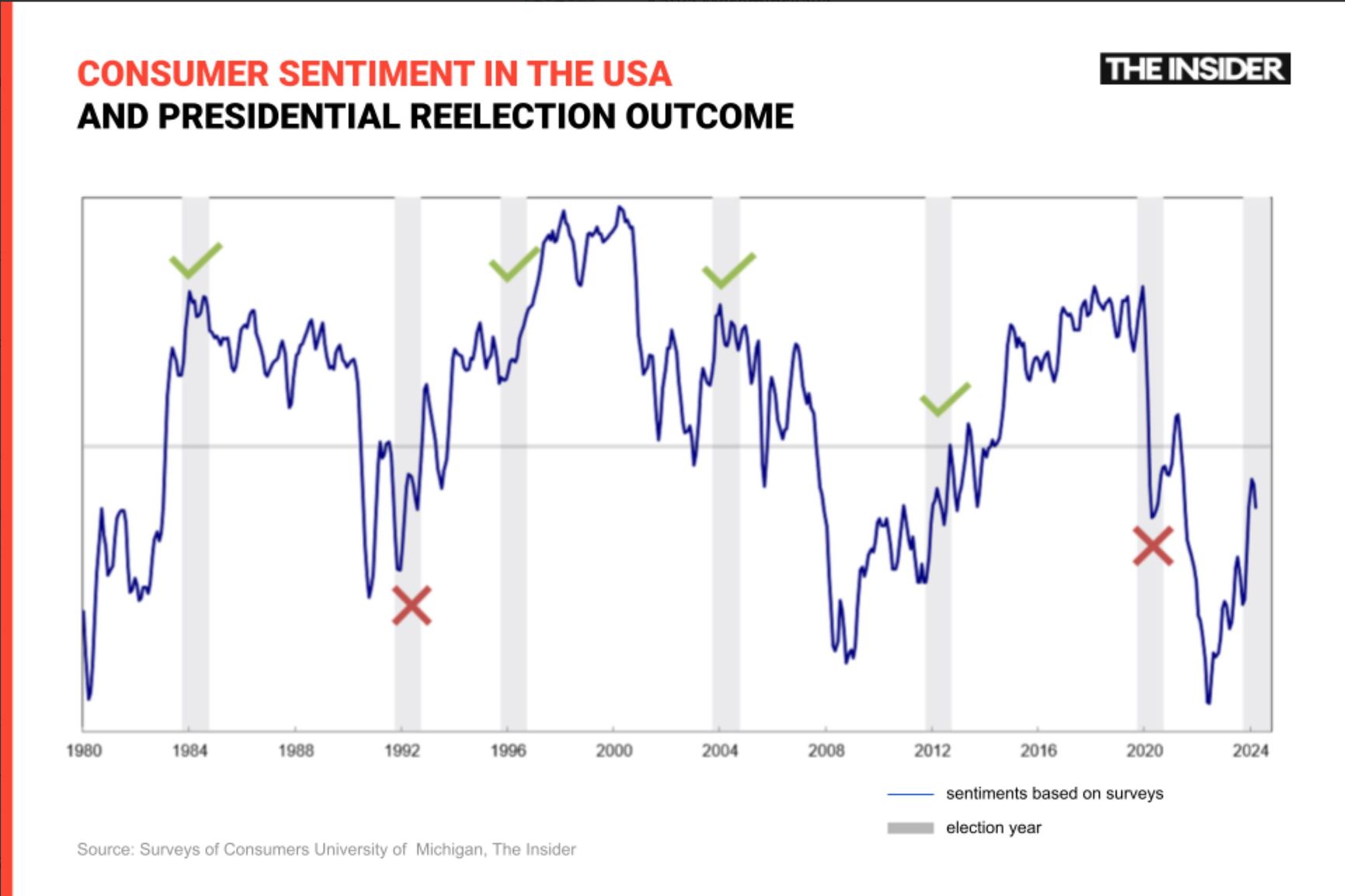

Most voters are unsure whether Biden can improve the situation if he is reelected in November. However, there is still some positive news for the incumbent: economic sentiment is slowly recovering. When sentiment has been below average, sitting presidents seeking a second term have been defeated at the polls, as happened to George Bush the elder in 1992. Still, the metric does not offer ironclad predictive power. After leading America’s recovery from the 2008 financial crisis, Barack Obama won a second term despite lingering negative voter sentiment — a scenario with certain parallels to Biden's post-pandemic situation.

Indeed, Americans remain discontented with the economy, but this dissatisfaction is gradually falling back towards average levels.

The interest rate is a key parameter of the financial system, determining the cost of money. Commercial banks borrow from the Federal Reserve based on this rate.

Real wages indicate how many goods and services can be purchased with a given salary. It is calculated by taking the index of nominal wages, expressed in monetary terms, divided by inflation.

From «vibe» and «recession»: A widely prevalent pessimistic view of the economy despite optimistic statistical indicators.

The Trump campaign remains intent on highlighting inflation as one of Biden's key vulnerabilities. “Workers and families are literally paying the price for Joe Biden’s failed economic policies, with prices on household essentials like gas, food, rent, and diapers skyrocketing,” Trump campaign spokeswoman Karoline Leavitt said back in May.

However, economists anticipate that inflation will approach the Federal Reserve’s 2% target by summer, potentially allowing for an interest rate cut that could notably improve the overall economic outlook of the population. If this rate reduction occurs early enough to influence public opinion — which typically trails behind actual economic conditions — it would certainly bolster Biden's chances for reelection.

But until inflation and interest rates decrease, Biden and his administration must continue to persuade people that the economy is genuinely improving. They also need to emphasize that conditions were worse in 2020, and that Biden inherited an economy severely affected by the pandemic. This approach could prove effective. Currently, Trump leads in multiple swing state polls despite legal challenges that include his conviction for financial reporting misconduct. In order to win in November, Biden faces the challenging task of persuading voters to adopt a more optimistic outlook, and there is no guarantee that simply presenting the facts will get the job done.

The interest rate is a key parameter of the financial system, determining the cost of money. Commercial banks borrow from the Federal Reserve based on this rate.

Real wages indicate how many goods and services can be purchased with a given salary. It is calculated by taking the index of nominal wages, expressed in monetary terms, divided by inflation.

From «vibe» and «recession»: A widely prevalent pessimistic view of the economy despite optimistic statistical indicators.