On December 31, 2024, the five-year contract providing for Russian natural gas to be shipped through Ukraine will expire. Gazprom is obligated to pay for the transit regardless of whether it uses it in full, in part, or not at all. Gas is being pumped through the pipeline despite the war: landlocked European countries rely on it. But now the extension of the contract seems very unlikely. And if Ukraine and Europe as a whole are ready for it, it will be a very painful blow to Gazprom, which has already suffered record losses due to a drop in exports and significant tax payouts, and will apparently pay no dividends to shareholders for the third year in a row.

Content

Implications for Russia

Implications for Austria

Implications for Slovakia

Implications for Hungary

Implications for Italy

Implications for the EU as a whole

Implications for Ukraine

Implications for Russia

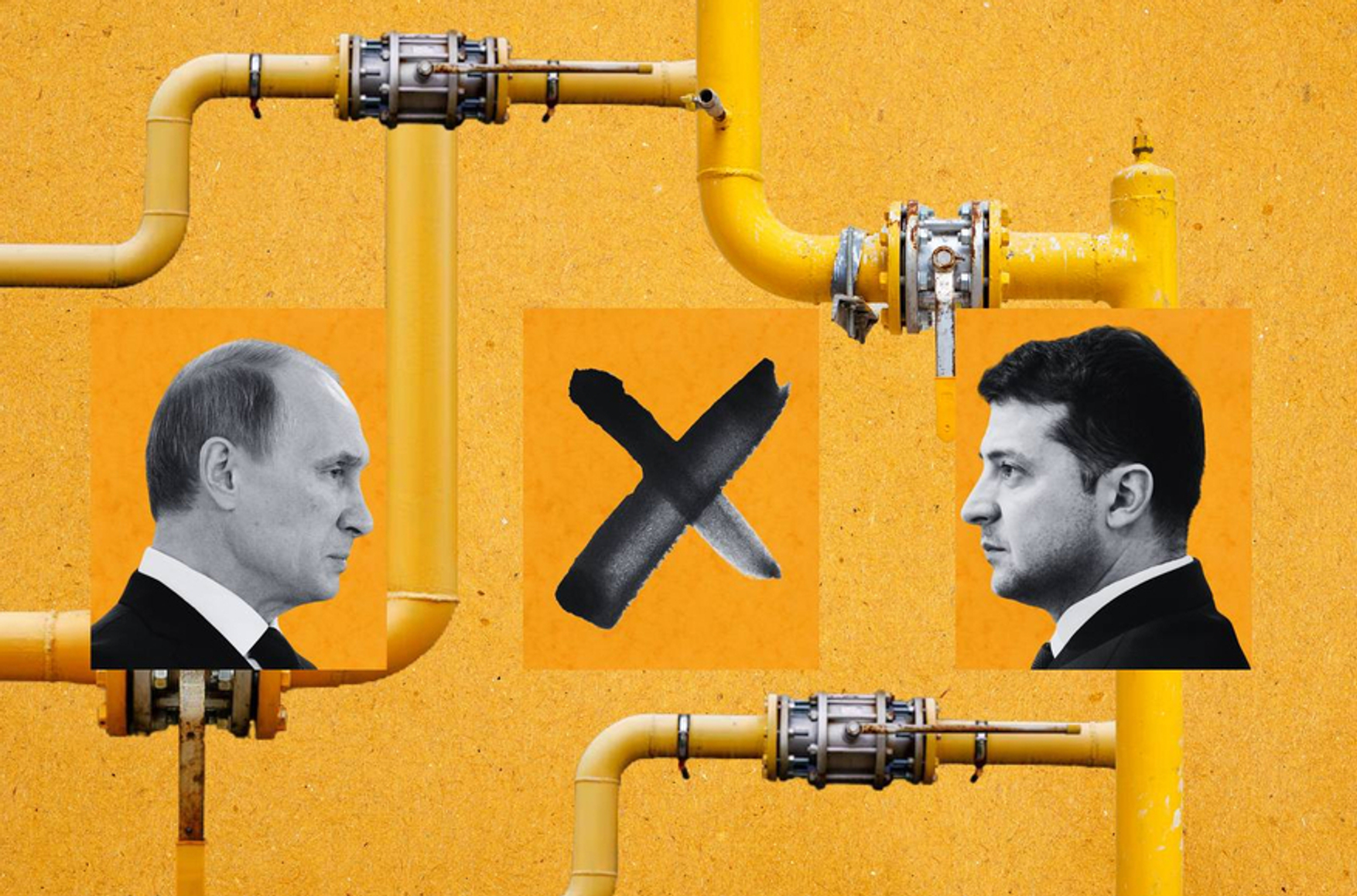

The transit of Russian gas through Ukraine has dropped significantly since February 24, 2022. In 2023, its volume was only 34% of what it had been in 2021. Under a contract signed in 2019, Russian company Gazprom promised to deliver 65 billion cubic meters of gas to European customers via Ukraine in the year 2020 and at least 40 billion in each of the following four years. In reality, however, only 15 billion cubic meters were delivered in 2023, as only one of the two entry points remained open. Ukraine has not controlled the Novopskov gas compressor station in the occupied Luhansk region since May 2022 — which is why Kyiv rejects all applications for supply through the Sokhranivka gas metering station (GMS), located on Ukraine’s internationally recognized border with Russia. In May 2022, as a result of Russia’s unprovoked full-scale military invasion, the Ukrainian side declared a “force majeure” — a clause invoked when a business is hit by something beyond its control — thereby relieving it of any obligation to fulfill the 2019 contract. Gazprom, however, argues that there are no grounds for a force majeure. In any case, only the Sudzha gas metering station further west remains in operation.

Map of gas metering stations (GMS) and compression stations on the Ukraine-Russia border, capacity as of May 2022

Source: Gas Transmission System Operator of Ukraine

The main consumers of Russian natural gas delivered to Europe via this route are Austria (6 billion cubic meters), Slovakia (6 billion cubic meters), and Hungary (1 billion cubic meters).

Transit through Ukraine remains one of two operational routes for shipping gas from Russia to Europe via pipeline. Before the full-scale war, there were four: Nord Stream 1, which ran under the Baltic Sea between Vyborg, Russia and Lubmin, Germany; Yamal-Europe, an overland route between northern Russia and Górzyca, Poland; TurkStream, under the Black Sea from Anapa, Russia to Kıyıköy, Turkey; and the various routes through Ukraine. Russia also exported liquefied natural gas (LNG), accounting for around 6% of its total gas exports to Europe.

At the end of September 2022, both lines of Nord Stream 1 and one of the two lines of Nord Stream 2 — which was completed in 2021 but was not yet online for delivering gas — were shut down following explosions, and it is unlikely that the latter will ever be put back into operation. Russian gas exports through Yamal-Europe stopped even earlier, in May 2022, due to Russian sanctions against the Polish owner of the pipeline.

Overall, Russian gas exports to Europe in 2023 fell to their lowest levels since the 1970s, and Russia’s capacity to divert gas from European customers to China is limited by the fact that Europe is supplied from fields in Western Siberia, while China is supplied from fields in Eastern Siberia (via the Power of Siberia-1 pipeline). The much discussed Power of Siberia-2 pipeline could connect these fields, but China appears to be in no hurry to approve the project.

Ramping up LNG production is another option for Russia, but U.S. sanctions on specific LNG projects present an obstacle, as even Chinese and Indian potential customers have avoided buying LNG from sanctioned entities.

Given this context, any new restriction on Russia's ability to deliver its gas to foreign consumers becomes particularly painful for Moscow.

Implications for Austria

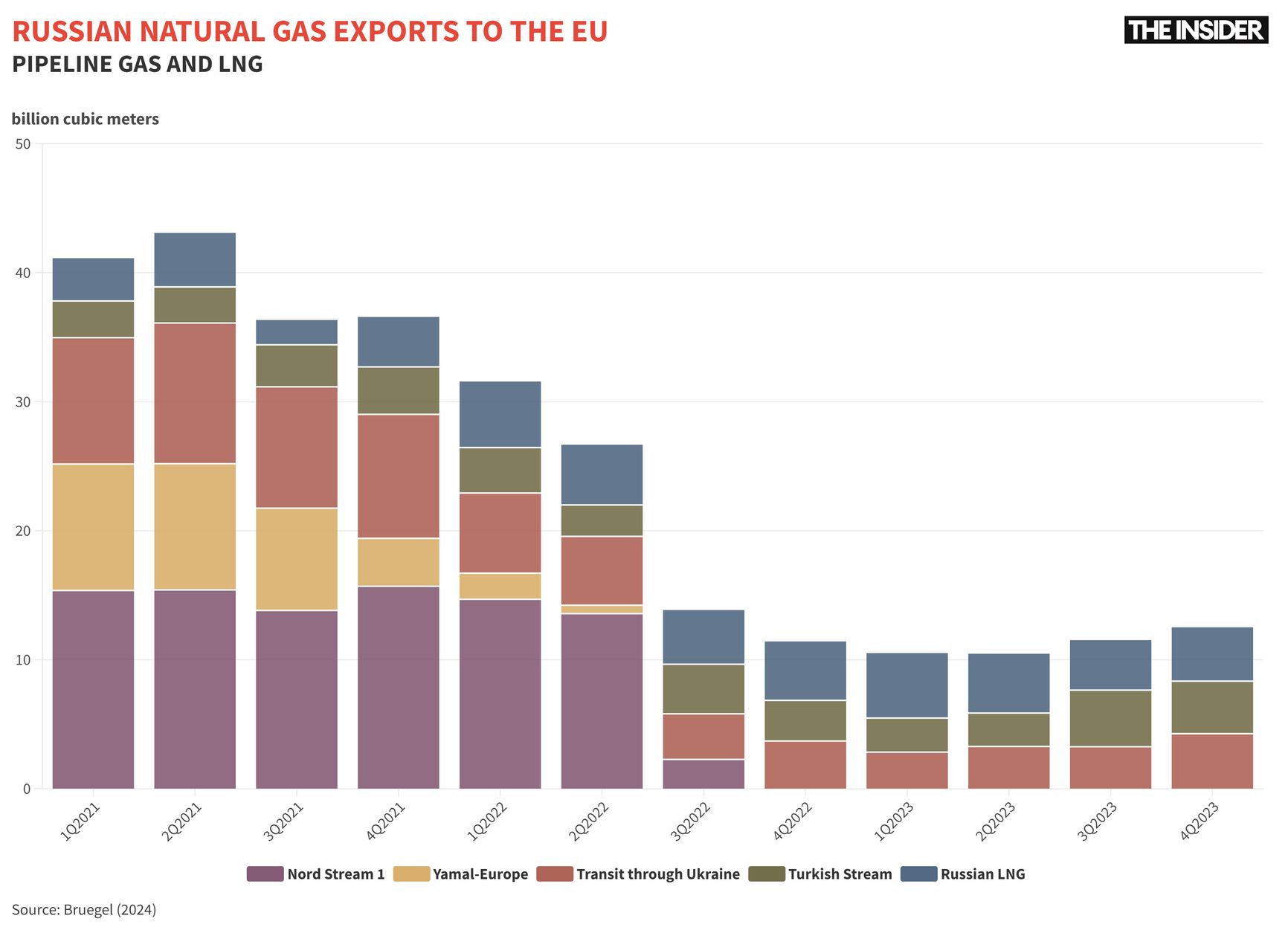

Austria is home to the Central European Gas Hub (Baumgarten), which distributes Russian gas to Hungary, Italy, and Slovenia while keeping around half for its own use. Unsurprisingly, Austria exhibits the highest dependence on Russian gas in all of Europe. As of December 2023, Russian gas still accounted for 98% of the country’s consumption — even higher than the 78% figure recorded in February 2022, the month when Russia launched its full-scale invasion of Ukraine.

That being said, Austria's consumption of Russian gas has decreased in absolute terms, as the country as a whole started to consume less gas. This move follows from a July 2022 EU directive urging member states to voluntarily reduce gas consumption by 15% compared to their average of the previous five years. Still, the long-term contract for Russian gas supply to Austria, signed in 2018, will not expire until 2040. As Austrian Minister for Climate Protection and Energy Leonore Gewessler recently stated, the country's dependence on “Russian natural gas threatens the country's prosperity, security and future.”

If Austrian companies do not give up Russian gas on their own initiative, the government may oblige them to do so. Russian gas is not under sanctions, but the country has already drafted a bill suggesting that the share of supply will drop to 60% by 2025 — and to 0% by 2028. To become law, the bill would need to be approved by the Austrian People's Party, which holds a plurality in the National Council, along with a two-thirds majority of the body as a whole.

However, an abrupt cut-off of gas supplies through Ukraine could have a spillover effect on prices and, consequently, lead to a jump in inflation. While representatives of the partly state-owned Austrian energy company OMV said that — if necessary — they would be able to supply their customers in Austria with 100% non-Russian gas, they did not say where such gas might be sourced from.

Technically, Austria can get gas from Germany. To this end, Gas Connect Austria, which owns and operates the country's gas transmission system, has started to expand the capacity of the West Austria Gasleitung WAG — the main gas pipeline running from the Baumgarten hub on the border with Slovakia to Oberkappel on the border with Germany. However, the project is not expected to be completed until 2027 at the earliest.

Still, as per a comment to Bloomberg from Walter Bolz, a spokesman for Gas Connect Austria and the former head of Austrian energy regulator Energie-Control Austria, the country will be able to meet gas demand in 2025 without Russian supplies, even if such a scenario would involve adapting to higher prices. As Bolz warned in December of last year:

“The risk in 2025 and 2026 is not so much that there will be no gas available, but that prices could again be quite high. We need to avoid another price crisis.”

Implications for Slovakia

Before the war, Slovakia was almost entirely dependent on energy imports from Russia. At the beginning of 2022, about 85% of the gas it consumed came from Russia via Ukraine, with the remaining 15% imported from Czechia (which mostly sold along Russian gas it had imported). Unlike Austria, however, Slovakia quickly began to diversify its supplies, replacing one-third of its Russian gas by the end of 2022. In February of this year, it received a shipment of LNG for the first time via Greece and also signed a contract for Norwegian gas.

By the end of 2022, Slovakia managed to replace a third of Russian gas with supplies from other countries

It should be noted that the two countries that still receive Russian gas delivered via Ukraine — Hungary and Slovakia — are participants in the Vertical Corridor project, announced by Hungary, Romania, Bulgaria, and Greece back in 2016, with Ukraine, Moldova, and Slovakia set to join them in 2024. The corridor will allow transportation of Azerbaijani gas coming to Greece through the TANAP-TAP pipeline, as well as gas from LNG terminals in Greece, which will go through Ukraine to Central Europe.

Ukraine is open to negotiations with the EU on the use of its gas transportation system, which is one of the largest in the world. Thus, Ukraine may once again become a transit country for gas — just not Russian gas — though if that happens, the risk of Russian attacks against Ukraine's gas pipelines and storage facilities will rise sharply.

Ukraine may once again become a transit country for gas — just not for Russian gas

Implications for Hungary

Hungary is practically independent of Ukrainian transit. Recently, the country has been receiving almost all of its Russian gas via the TurkStream pipeline. Still maintaining close ties with Russia, Hungary opposes tougher Western sanctions and has no plans to stop buying Russian gas. The country's key officials claim that Hungary’s energy decisions are made based on two criteria — price, and security of supply — with no regard for political and ideological factors.

Paradoxically, Hungary’s trade with Russia may not be so favorable — according to estimates made by the Hungarian publication Népszava, the country has been losing significant amounts of money on its gas contracts. This is due to the fact that the current contract was signed in October 2021 — when the natural gas crisis was already in full swing and prices were relatively high.

Although the terms of the deal remain confidential, according to Népszava, the Kremlin has been selling its gas to Budapest for up to 30% above the market price. Népszava estimates that Hungary's financial loss from buying Russian gas in 2022-2023 amounted to 564 billion forints, equivalent to 1.43 billion euros.

Implications for Italy

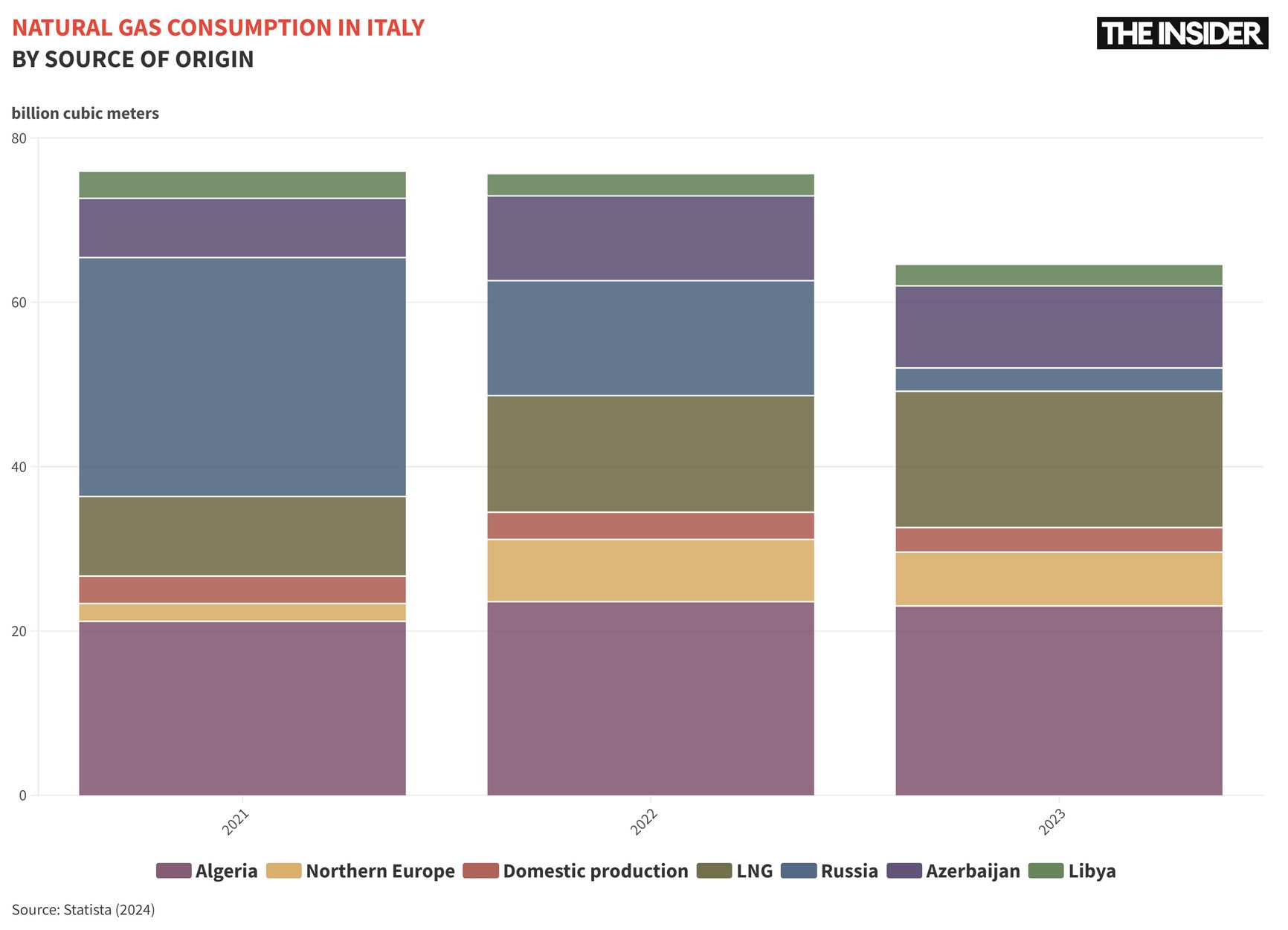

Italy has already survived its gas breakup with Russia. In 2021, Moscow was the country’s largest supplier, accounting for 38% of all gas consumed in Italy. In the second half of 2023, that figure shrunk to 2%.

These changes were achieved by reducing gas consumption, increasing gas imports from Azerbaijan, and increasing LNG imports, which now come mainly from Qatar, Algeria, and the United States. Algeria has become the largest gas supplier to Italy, which, in addition to LNG, supplies Italy with gas via the Trans-Mediterranean Pipeline.

Implications for the EU as a whole

According to a statement by EU Energy Commissioner Kadri Simson in February, there is no need to extend the bloc’s transit contract with Russia. While concern remains that halting Russian gas transit through Ukraine could drive up prices, costs also depend on factors including import diversification, gas reserves in underground storage, weather conditions, and tax rates. Stopping transit would play a role, but far from the only one.

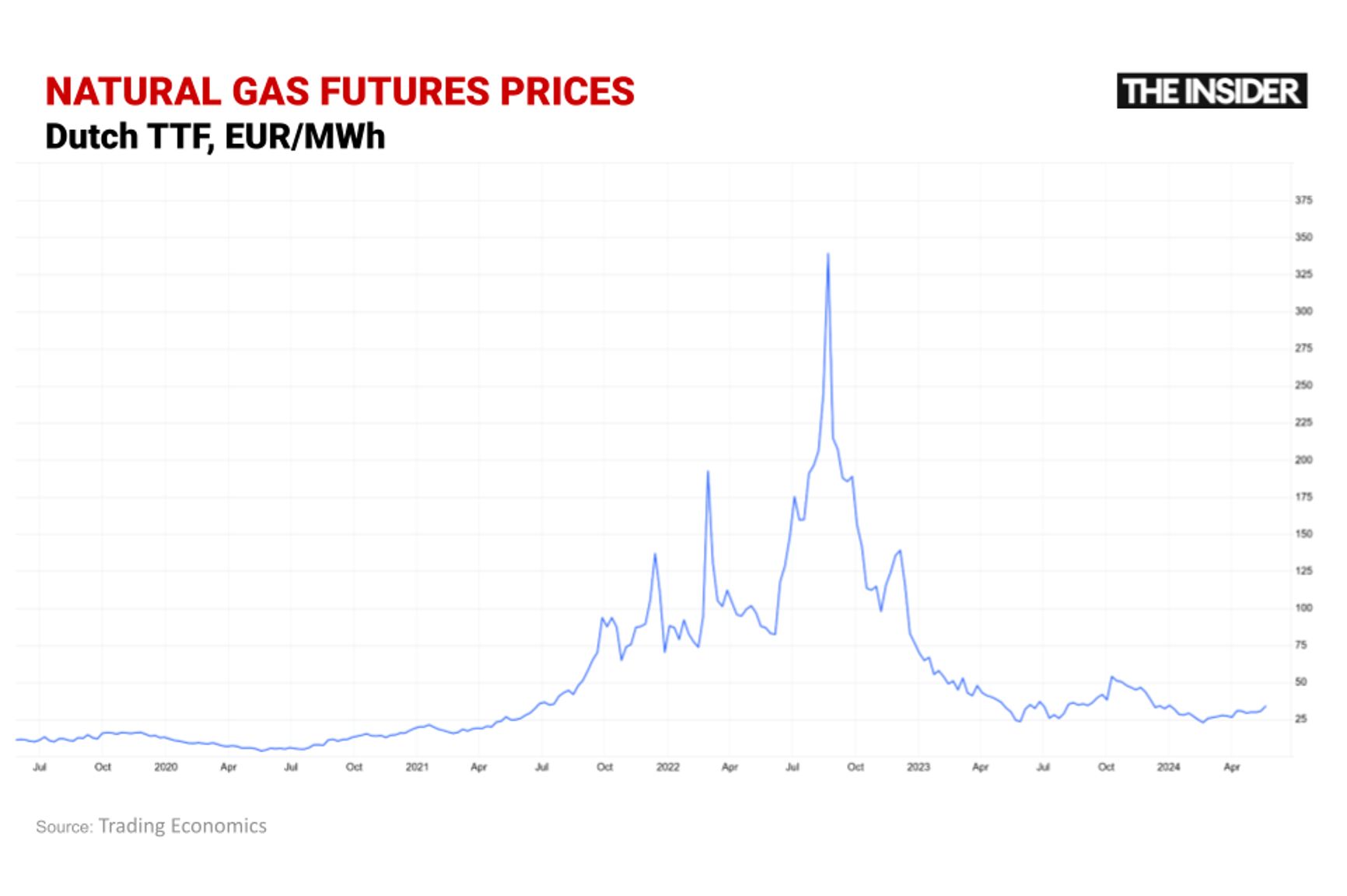

The main benchmark for the price of natural gas in continental Europe is the gas futures contract on the virtual hub in the Netherlands, known as TTF (Title Transfer Facility). The price in many of Gazprom's long-term contracts was determined on the basis of a basket of spot gas and oil prices. Moreover, over the past few years, the EU has tried to move away from long-term contracts in favor of spot contracts, which depend on the price of TTF futures.

Over the last few months, the gas futures prices at the TTF hub have been lower than they were before the beginning of the Russian invasion of Ukraine — falling to levels last seen in June 2021. In other words, the price situation is relatively calm at the moment, and the market may even already be pricing in the expectation that the flow of Russian gas via Ukraine will soon stop altogether.

Finally, even if Russian gas continues to flow through Ukraine after December 31, it will not continue to do so for long. According to the European Commission's RePowerEU plan, EU countries will have to wean themselves off of Russian gas completely by 2027.

Implications for Ukraine

First, the Ukrainian state-owned company Naftogaz, which is responsible for organizing the transit of Russian gas through the country, will lose out on transit payments, which currently amount to around $800 million a year. According to the current contract, however, they should have been $1.2 billion. Russia is underpaying because Ukraine is rejecting bids for the Sokhranivka station, and since the the company transfers the entirety of the transit fee to the Gas Transmission System (GTS) Operator of Ukraine, which owns the infrastructure, Naftogaz has been incurring losses on the transit of Russian gas for almost two years running. Naftogaz has sued Gazprom in the Stockholm Arbitration Court for underpaying, with a decision expected in early 2026.

Ukraine's revenues from Russian gas transit are relatively small, amounting to less than 0.5% of GDP in 2023. Still, after Russian transit ceases, the Ukrainian GTS will need to be supported from other sources.

But such a move seems inevitable. It is difficult for Ukraine to maintain cooperation with Russia against the backdrop of the ongoing full-scale war, especially considering Kyiv’s insistence on tightening international sanctions against Moscow. As a result, Ukrainian Energy Minister German Galushchenko has ruled out even entering into transit negotiations with Russia.

While Europe is quickly transitioning to life without Russian gas, the looming transit halt threatens to disrupt the supply for customers in Ukraine itself. While Ukraine stopped importing Russian gas directly in 2015, the country is believed to buy Russian gas from third parties in Europe via the so-called “virtual reverse” mechanism.

If Russian gas transit through Ukraine stops, so will the reverse flow. However, a 2023 stress test, initiated by Ukraine's Ministry of Energy and conducted with the help of USAID, Naftogaz, the GTS operator, and other organizations, demonstrated the reliability of gas transportation and storage through Ukraine's GTS under the conditions of zero Russian gas transit. Ukraine is also boosting domestic gas production. According to Galushchenko, the country could even achieve full gas self-sufficiency by 2024.

The termination of Russian gas transit through Ukraine will create challenges for all parties involved. However, the party most affected will likely be Russia, as it can only redirect a small portion of the lost Ukrainian transit volumes to the already heavily utilized Turkish Stream. For Ukraine, the politically optimal solution would be to end Russian gas transit and reorient its GTS towards gas storage on behalf of the EU and the transit of Azerbaijani gas to Central Europe.