By opening up an energy front and provoking the biggest crisis in decades, Vladimir Putin hoped that Europe would freeze over the coming winter. What he forgot to consider was the transition to renewable energy in the EU and the US was a solid trend long before the war in Ukraine. It is becoming increasingly cheaper and more convenient to switch to biofuels, wind, solar, and, in the future, to green hydrogen. Russia's energy blackmail has only accelerated this process. And although the full transition to renewable energy sources is being targeted for 2050, their share in the EU alone will double in a few years’ time, accounting for about half of all energy consumption. Putin’s gamble has failed – in wanting to prove that Europe cannot survive without Russian oil and gas, he finally convinced the Europeans to move away from hydrocarbons for good.

Content

What is renewable energy?

Price of renewables slides while adoption grows

Renewable energy as policy

Wind power

Bioenergy

Green hydrogen: the future of energy

Green energy in Russia

One year ago, world leaders gathered at the COP22 summit in Glasgow to discuss climate change and the transition to carbon-free energy. While that may be hard to believe, the event really was among the most-talked-about topics in 2021, as Covid had become routine, and Russia's invasion of Ukraine was still months away.

Almost all world leaders were present in Glasgow, with Ukrainian President Volodymyr Zelensky taking the floor, among others, and calling Crimea and Donbas «ticking time bombs.” Only the leaders of Russia and China were absent – the summit organizers even made sure to turn off the video link to prevent them from speaking remotely.

Much was expected of the summit, but its results were satisfactory at best – a global consensus with no breakthroughs. In 2022, environmental issues were sharply displaced by the war in Ukraine (although the issues themselves are as pressing and global as ever), and energy concerns have moved from theory to practice, with winter heating sources taking center stage.

Against the backdrop of a worsening energy crisis, some European countries even returned to coal and fuel oil (mazut) as a matter of urgency. Does that mean that all plans for the green energy transition are now headed for the trash? In short – no. On the contrary, it’ll likely happen faster than expected: the harsher the energy crisis, the stronger the desire of hydrocarbon-dependent countries to give them up. Let’s take a look at what the world has already done to switch to renewable energy sources.

What is renewable energy?

Renewable energy sources (RES) are so called as they are replenished faster than they are consumed. This is their main difference from fossil fuels – oil, gas and coal – the reserves of which, although sizable, are still finite (according to current estimates, oil and gas may run out in about 50 years, while coal has a lifespan of around 70 years).

Oil and gas may run out in about 50 years, while coal has a lifespan of around 70 years

The environmental aspect of RES is critical, given the fact that the main source of greenhouse gases today is the burning of fossil fuels. These gases – carbon dioxide in particular – lead to the increases in the average temperatures across the Earth, which can cause radical and irreversible climate change.

In 2015, a special international conference adopted the Paris Agreement, which aims to keep the global average temperature rise this century «well below» 2°C and seeks to limit the rise to 1.5°C.

Five years later, in May 2021, the International Energy Agency (IEA) responded to individual countries' plans for carbon neutrality by publishing a roadmap that, if followed, would allow the world to reduce emissions to zero by 2050 and achieve compliance with the Paris Agreement's temperature framework.

This IEA roadmap involves work on a number of fronts (political solutions, technology, supply chains, etc. are needed), but stopping investment in fossil fuel projects and replacing the share of coal, oil and gas in the global energy mix with renewables is the foundation of this plan.

Price of renewables slides while adoption grows

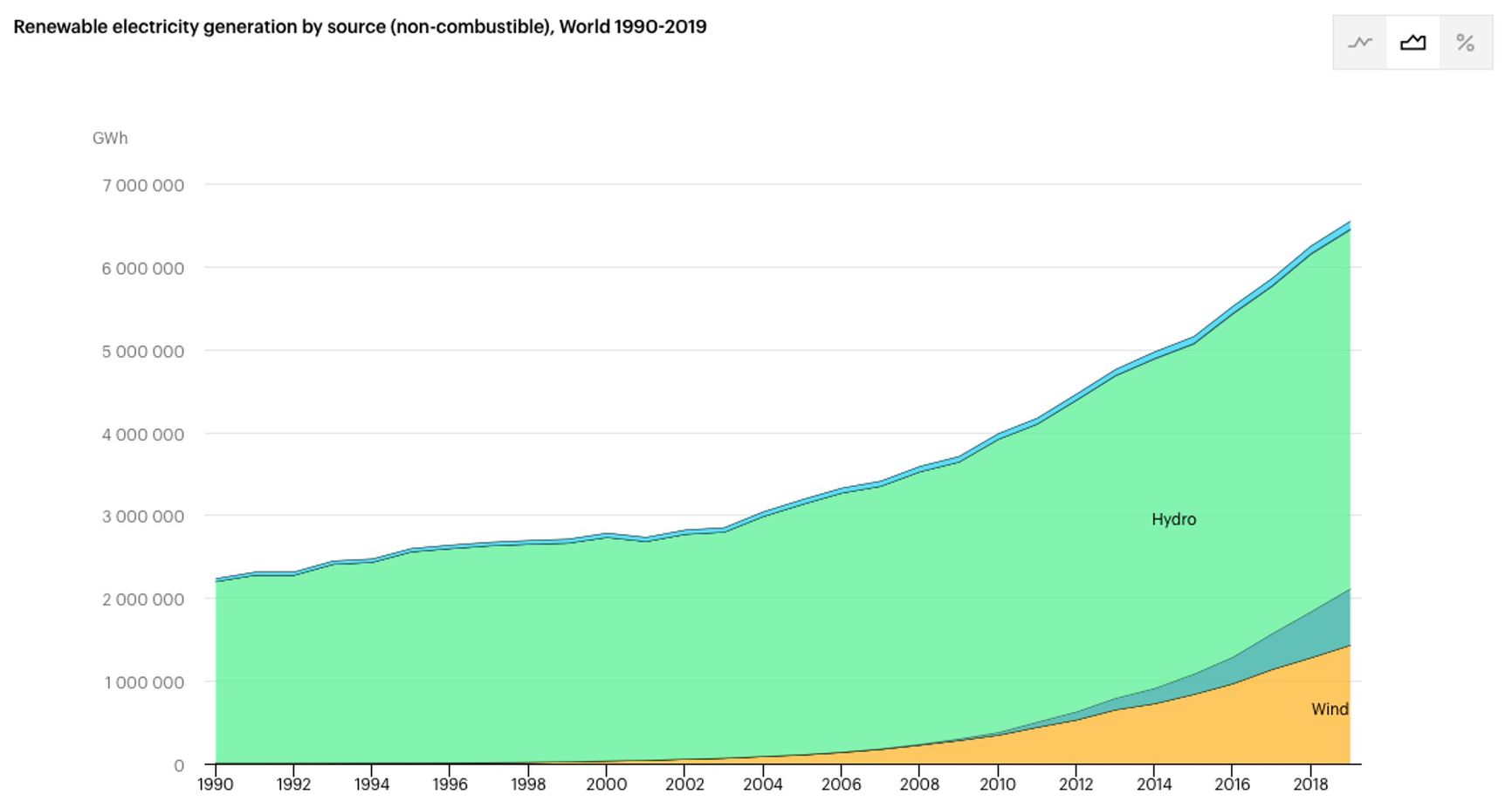

The share of renewables in the global energy balance is steadily growing, regardless of the war and the current energy crisis: coming in at less than 5% in 2019, it jumped to 5.7% in 2020. Renewables account for an even higher share of global electricity production – 29% in 2020 (up from 27% in 2019).

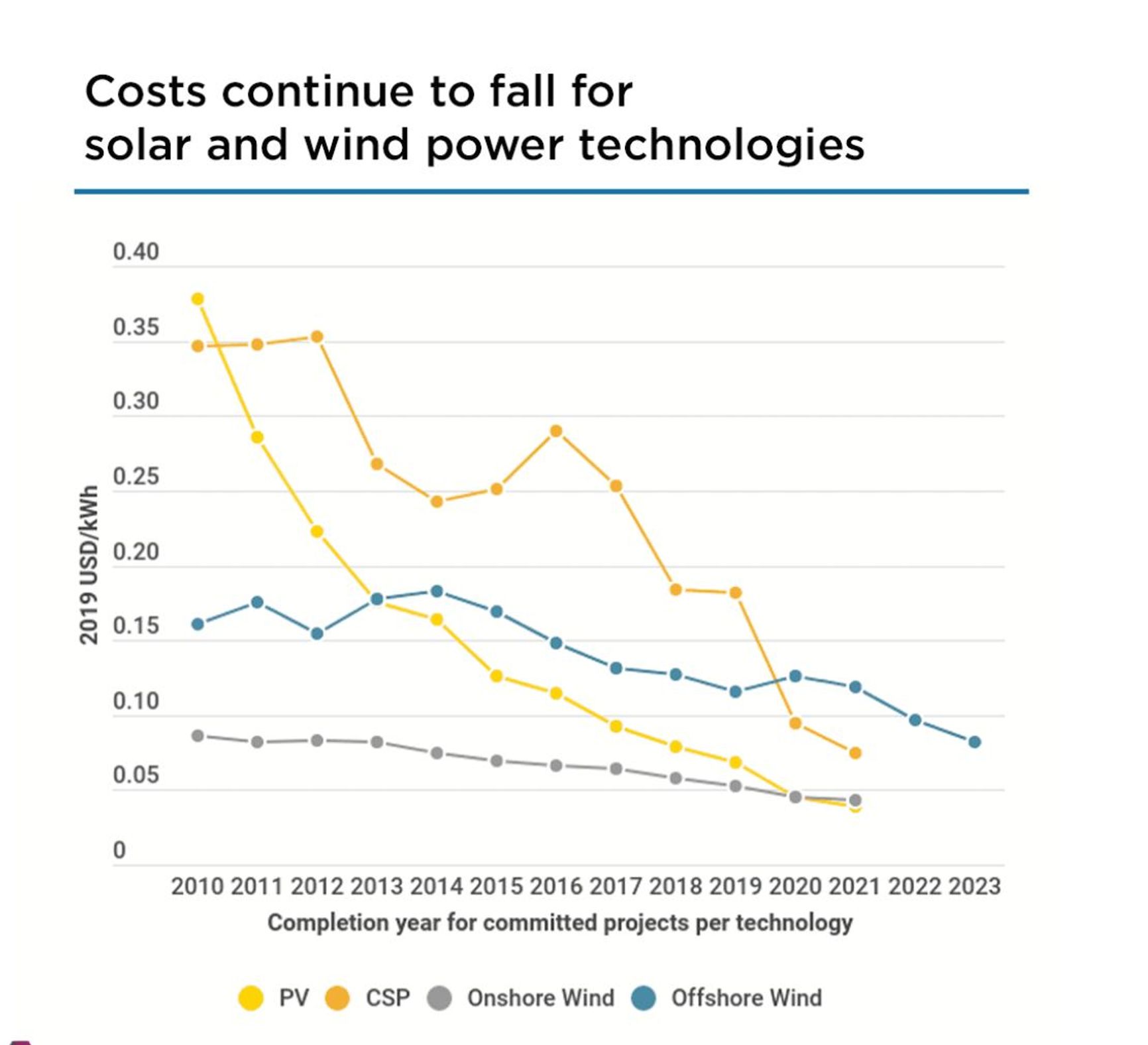

Looking at the longer term, from 2015 to 2020, wind and solar capacity more than doubled by about 800 gigawatts (GW) at an average annual growth rate of 18% – much quicker than most market analysts expected. Why is this happening? First of all, this is due to RES becoming cheaper and more affordable. For example, prices of onshore wind and solar energy have fallen by about 40% and 55%, respectively, over the last five years.

The cost of onshore wind and solar energy has fallen by about 40% and 55% respectively

According to the International Renewable Energy Agency (IRENA), the cost of electricity from general purpose solar photovoltaic systems fell by 85% from 2010 to 2020. The cost of electricity from concentrated solar power (CSP) systems has slid by 68%, while power from onshore and offshore wind turbines has become 56% and 48% cheaper respectively.

On average, prices for solar photovoltaic systems commissioned in 2021 hover around the $0.039/kWh mark. That's 42% lower than in 2019, and 20% less than the cheapest fossil fuel competitor – coal-fired power plants. Simply put, giving up dirty coal is becoming more and more profitable.

The efficiency of investments in renewable energy has also increased: the same amount of money invested in renewable energy now produces more new capacity than ten years ago. Twice as much renewable energy capacity was introduced in 2019 than in 2010, taking just 18% more investment.

Renewable energy as policy

Until recently, private investment efficiency in RES couldn’t even be compared to the benefits of hydrocarbon projects. Nevertheless, the sector has received serious political support at both international and local levels – it would hardly be as developed today without that assistance, as well as the numerous subsidies that have come their way.

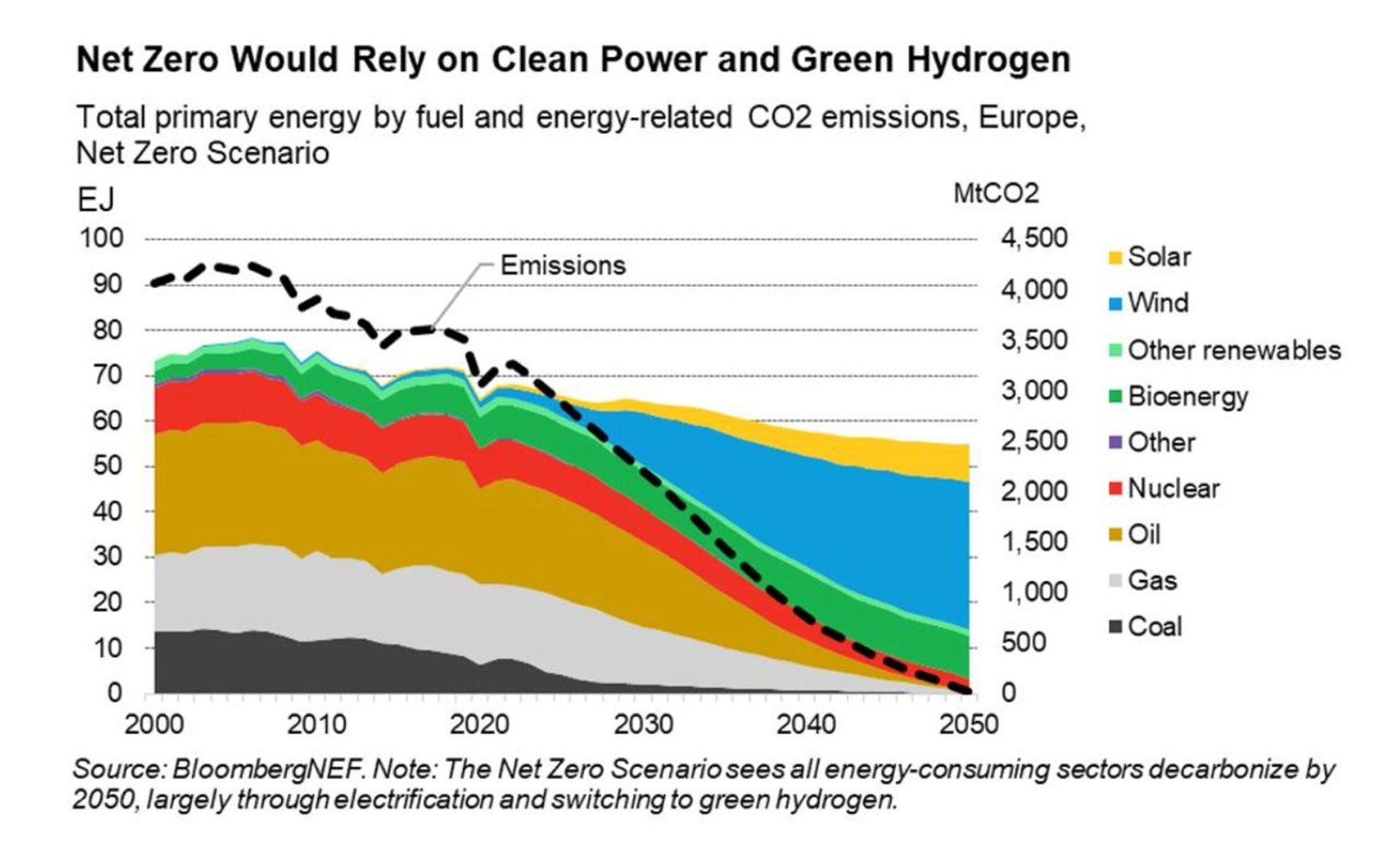

In the international arena, the European Union has been the global leader in the pace of the energy transition and the development of RES for many years now. In 2022, the EU adopted a new energy plan called REPower, which aims to reduce the consumption of Russian gas by 67% and will stop purchasing the commodity outright «much earlier than 2030» (this refers to a refusal to buy any gas – not just Russian gas). However, given the way events are unfolding – particularly in light of the recent «incident» on the Nord Stream pipeline – the transition may even happen even more rapidly.

The EU will cut consumption of Russian gas by 67% this year

According to the EU plan, Russian gas will initially be replaced by similar deliveries from other countries, as well as by coal and fuel oil – by 2030, however, the share of hydrocarbons and coal should decrease due to the growth of the renewable energy market. The complete abandonment of fossil fuels in Europe is scheduled for 2050 and could cost $5.3 trillion.

In 2020 the share of renewable energy sources in the EU balance was 22%. That figure will rise to 45% by 2030, according to REPowerEU.

In particular, the focus will be on the fast-growing market for solar panels. By 2025 their number in Europe should increase twofold – up to 320 GW, reaching 600 GW by 2030.

Similar developments are taking place in the United States. New solar projects will account for 60% of the generating capacity that will be commissioned in the US in 2022 and 2023.

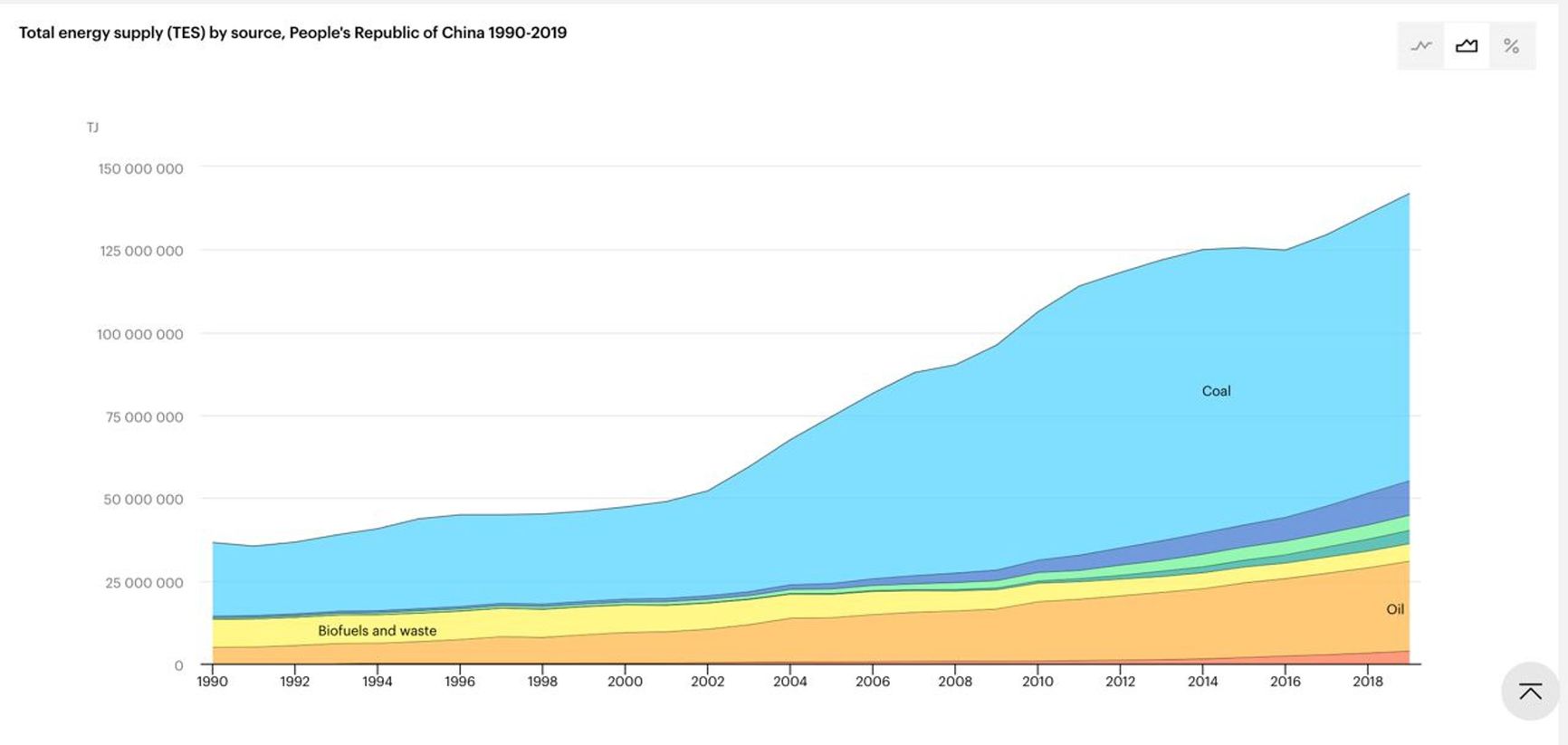

The solar panel market, however, has its own problem – localization. Over the past decade, production capacities have migrated from Europe, Japan and the US to China, which has become a leader in investment and innovation in photovoltaic solar panels. China's share in all key stages of solar panel production now exceeds 80%, while its share in the manufacture of their key elements (polysilicon and wafers) will soon exceed 95%.

On the whole, China's RES market is steadily growing and is more than twice as large as the US market that trails it in terms of energy production. However, the volume of energy consumption and its growth rate in the country are so high that the share of renewables is just «sinking» in the overall picture so far.

Wind power

The wind energy market, though growing at a slower pace, currently occupies the largest share in the RES pie. Last year, global wind power generation rose by a record 273 terawatt-hours (TWh), or 17%.

In 2021, China accounted for almost 70% of the growth in wind generation, followed by the US with 14% and Brazil with 7%. In the EU, despite near-record capacity growth in 2020 and 2021, wind power generation itself fell last year by 3%, due to unusually long periods of weak wind (this factor also has to be taken into account).

Nevertheless, even this is not yet enough to meet the IEA's scenario of global carbon neutrality by 2050, which implies a level of 7900 TWh in 2030. According to this scenario the average growth during 2022-2030 should be 18%.

https://www.iea.org/fuels-and-technologies/renewables

Wind is one of the cheapest renewable energy sources. But it also has its challenges: fluctuations of energy flow depending on the season and time of day (as wind currents are uneven) and transportation (wind turbines are mostly installed in rural areas, on the coast or in the sea, complicating energy delivery).

Building taller and larger wind turbines (the taller and larger the mechanism, the more wind it captures), developing intelligent modeling in machine learning to optimize the operation of turbines at different times of the year and day, and improving storage methods are the challenges facing the sector. So far, there are only isolated successful cases of hybrid energy systems, but the future likely lies in a «smart» combination of several types of RES, storage, and backup capacities.

Bioenergy

Bioenergy is already making an important contribution to the energy security and sustainability of the global energy system. Without it, the current situation would be much more complicated. As the world's largest renewable energy source, bioenergy promotes diversification, provides energy security, and helps dampen elevated market prices.

Bioenergy is also the most versatile form of renewable energy. It can supply heat and electricity, act as fuel for transportation, or be a source of biomethane (renewable gas). One of bioenergy’s key advantages is that it can use existing infrastructure, which allows for a rapid increase in the number of its end uses. For example, biomethane can be used in existing gas pipelines and end-user equipment, while many liquid biofuels can be run through existing oil distribution networks and power vehicles with little or no modification. This is critical for reducing emissions from existing vehicle fleets in developing countries.

Today, the cost of biogas production worldwide ranges from $2/MBtu (thousand British thermal units) to $20/MBtu. There is also considerable variation between regions – the average cost of biogas in Europe is about $16/MBtu, while the cost in Southeast Asia comes in at around $9/MBtu. At the time of writing, the US Henry Hub gas benchmark traded at $6.8/MBtu.

Green hydrogen: the future of energy

While everything is more or less clear when it comes to wind and solar energy, green hydrogen is far more complex, as there is still no large-scale practical base for its production and use. Despite these challenges, multiple experts are sure that hydrogen will play the leading role in the global phase-out of natural gas.

Green hydrogen will play the leading role in the global phase-out of natural gas

Its main advantage is the possibility to deliver it to the bottlenecks of infrastructure in Central Europe that are the most vulnerable today, as these countries have built their national energy industries based on Russian pipelines. As it aims to change that, REPowerEU targets producing 10 million tons of hydrogen inside the EU and importing the same amount by 2030.

The projected growth of green hydrogen production will also provide an opportunity to create new jobs and retrain the existing workforce. This could not be more relevant for the economies of Central and Eastern Europe, which are currently on the verge of recession.

In addition, hydrogen and its derivatives (like synthetic fuels) can also help reduce CO2 emissions from maritime, aviation, and heavy land transport.

Today, over 100 projects aimed at trading hydrogen (or its derivatives such as ammonia and synthetic fuels) are being developed all over the world, about half of them based in Southeast Asia. If all of these projects come to fruition, the equivalent of almost 5 million tons of hydrogen could be traded by 2030.

This market is in its infancy – for it to function properly, it requires adequate export-import infrastructure, supply stability, and commercially available technology. Significant investment is also needed along the entire value chain, including renewable energy capacity, infrastructure for hydrogen transportation and storage, and production capacities for key technologies such as electrolysers and fuel cells.

It is difficult to retrace the logic of the Russian leadership, which decided to open an energy front along with a military front in Ukraine in 2022, triggering several sanctions packages against Moscow and leading to the largest global energy crisis in decades.

Perhaps their calculation was that the Europeans are still far away from the finish line of an energy transition that was to take many decades (the earmarked completion date of 2050 might have created that false sense).

In fact, the transition to renewables became a solid trend long before the war in Ukraine – it is founded not on abstract ethical or environmental concerns, as it might seem to an outsider, but on economic ones. Switching to biofuels, wind and solar (and, in the future, to green hydrogen) is becoming cheaper and more convenient.

Switching to biofuels, wind and solar is becoming cheaper and more convenient

None of these long-term trends will be reversed. On the contrary, we can assume that Russia's actions have become their catalyst. Without the Kremlin's energy blackmail, the phase-out of hydrocarbons would have been much slower and the process might have actually taken longer, which would have given Russia enough time to restructure its own energy sector – and its economy.

Green energy in Russia

As for Russia itself, green energy projects were of serious discussion in the business community until February 2022, with multiple players searching for foreign partners. A special «taxonomy» – a list of promising domestic projects in the field of ESG – was even prepared as Russia looked to develop renewable energy sources.

“Green» projects in Russia, however, have always been assigned the role of complementing oil and gas. Investor interest was mainly concentrated in areas adjacent to fossil fuels – there was much talk about «blue» hydrogen (produced by steam conversion of methane with carbon capture and storage).

In reality, the lion's share of Russian advances in green energy were forced measures, no less than an irritated reaction to the demands of their Western counterparts and the introduction of new environmental restrictions.

Russia is now unlikely to find the funds that could be invested in capital-intensive renewable energy projects. This is especially true as the country's leadership has given clear signals about its attitude towards them.